EU Electrification rates are not on track for 2050: time for an Electrification Action plan

Throughout our daily lives we often take electricity for granted. Whether it is to deliver online education throughout a global pandemic, charge your smartphone to keep in touch with family, or simply keep the lights on, electricity is there.

As our society progresses and as we continue to decarbonise, electricity will become ever more present. It will power your car. It will heat your home. It will power ever smarter solutions, and it will come from a wide range of decentralised clean energy sources.

More power will be needed for greater decarbonisation. The European Commission makes this clear in its 2040 Communication which forecasts up to a doubling of the electricity share in the EU final energy consumption by 2040.

Consumers, businesses and governments are all looking to become sustainable and use more clean and renewable power. This comes along with the urgent need to create jobs, reduce pollution, boost innovation and cut Europe’s dependence on imported fossil fuels.

How has the electrification of Europe’s society evolved?

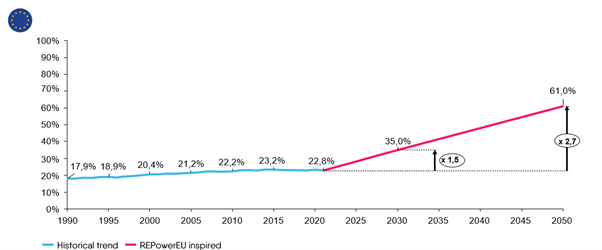

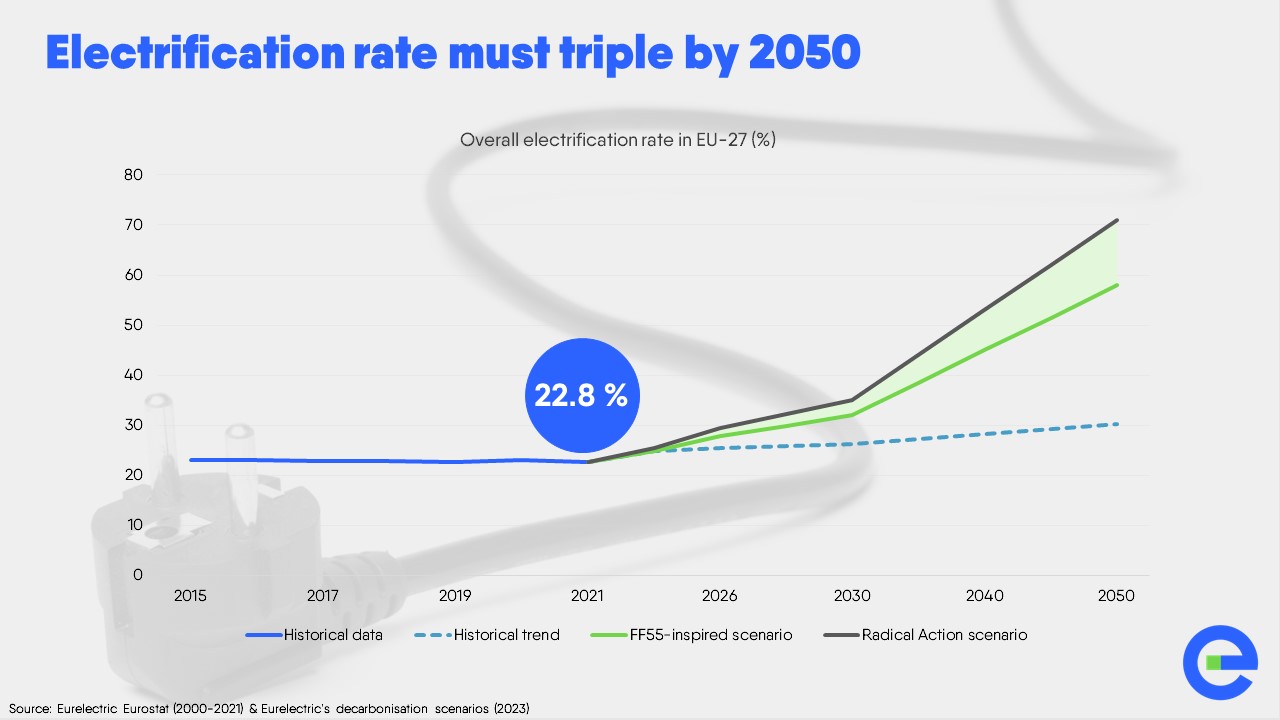

An shown in our latest report, the analysis of historical energy trends reveals that the electrification rate for final energy uses stayed almost flat during the last decade. After a gradual but continued increase since the 1990s, rates stagnated at around 22%-23% in the last five years.

Looking forward, in the vast majority of scenarios, the EU energy transition calls for a significant increase in electrification, leading to 35% by 2030 and 61% by 2050 according to the European Commission’s REPowerEU, the recent 2040 greenhouse gas (GHG) target Communication as well as Eurelectric’s Decarbonisation Speedways projections.

Global dynamics have a significant impact on the evolution of absolute electricity demand in Europe. A deeper investigation shows that, after a +1,6% annual average growth in the period 1990-2010, the demand increase halted after the global crisis in 2008 and the following geopolitical shocks and the COVID-19 pandemic.

When looking both at sectoral level – transport, heating and industry – and national level, the almost flat trend for electrification rate is common to all end-use sectors and countries. Despite different national starting points and depending on specific sectors, all rates experienced a similar evolution pattern.

Why does Europe need an Electrification Action Plan?

Today electricity makes up only 23% of all the energy consumed in Europe. This means that while we are working hard to decarbonise, large parts of the economy are still running on fossil fuels. Despite encouraging signals in 2022, the pace of adoption for electric vehicles (EVs) and heat pumps needs to increase three to four times in order to meet 2030 goals. If we are to have any hope of achieving our climate and energy policy, we need to ramp up electrification as quickly as possible.

Eurelectric’s Decarbonisation Speedways study shows that already in the medium term, Europe will need to reach an electrification rate of 35% by 2030 to achieve our REPowerEU ambitions. Europe must set both the right milestones and a clear plan to deliver that trajectory.

In the words of Eurelectric’s Secretary General Kristian Ruby:

“High-speed electrification of society requires massive investments and measures across the board. We therefore welcome the investment initiative and call on policy makers to launch an electrification action plan within the first 100 days of the new mandate.”

What should the EU Electrification Plan achieve?

To boost the much needed growth the EU Electrification Action Plan should:

- Set an indicative electrification target of 35% by 2030.

Such target must be complemented by an indicator in the National Energy and Climate Plans to monitor national implementation. - Remove barriers to the electrification business case

This means phasing out continued subsidies to fossil fuels (€56 billion over the period 2015-2021) and by correcting uneven taxation. Removing any non-power related taxes and levies from power bills will provide transparency when comparing costs and create favourable economic conditions for consumers to switch from more carbon-intensive energy carriers. - Raise awareness

Every citizen and business in Europe must be made aware of the benefits of direct electrification, including energy security, climate mitigation, and cost savings for consumers.

Let’s delve deeper into such benefits.

How can increased electrification benefit European consumers?

Several studies have repeatedly proven that direct electrification is the most cost and resource efficient way to achieve the EU climate and energy objectives. Let’s take a look at them.

Energy and costs savings

Our latest report shows that an EU average household could have saved around €150 per month in 2022 by electrifying their transport, heating and cooking. Still, consumer choices with regards to decarbonised solutions are in many cases not economically evident, mainly due to incoherent and insufficient incentives and an ongoing energy taxation policy which often favours gas over electricity use.

Looking at 2050, a study by the European Climate Foundation says electrifying the heat supply through a large-scale roll-out of heat pumps coupled with a high renovation rate would potentially halve households’ energy bills, cut fossil fuel imports spending by €43 billion and lead to a 1% increase in Europe’s annual GDP.

The Commission’s Joint Research Centre further emphasises the benefits of electrifying your heating system. Their study calculates that replacing 30 million existing gas and oil boilers with heat pumps and implementing partial building envelope renovations by 2030 would result in a 36% reduction in the total final energy consumption of gas and oil in those buildings. This reduction corresponds to 348 TWh of energy saved for residential space where approximately 40% of the installations involve switching to a heat pump without any improvement in the envelope efficiency, while the remaining 60% of the heat pump installations, including those replacing gas and oil boilers, are accompanied by building envelope renovation.

In the EU, Germany would reduce its gas and oil usage the greatest in absolute terms, with a potential saving of 125 TWh. That is followed by France with 50 TWh, Italy with 48 TWh, Spain with 22 TWh and the Netherlands with 18 TWh.

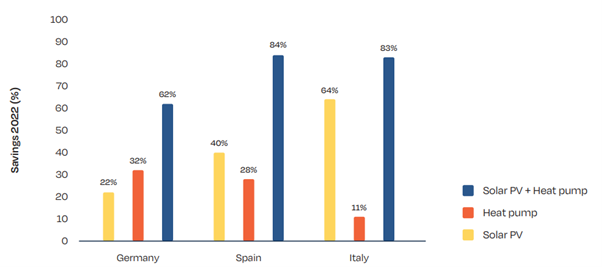

According to a recent SolarPower Europe study, residential owners of a solar photovoltaic (PV) system and a heat pump in Germany, Spain or Italy would have decreased their energy expenses by up to 84%.

Ten different case studies were carried out from actual homes across European countries. Each household applied an array of electrification solutions to meet their daily energy needs for heating, cooling and transportation - including heat pumps of different kinds, e-mobility, battery storage and solar PV. All case studies show positive monetary savings as well as overall satisfaction of owners from having detached themselves from fossil fuels while securing their energy supply thanks to electrification both from on-site resources and from the grid.

Energy security

The 2022 energy crisis has taught Europe to rethink its energy security. Replacing fossil fuel imports with domestically-generated clean and renewable power is key to securing our energy supply by lowering dependence on unreliable trade partners.

The transport sector is a case in point. Electric vehicles of all types are already displacing 1.5 million barrels/day of oil demand, shows BloombergNEF’s EV Outlook. Demand is set to rise dramatically in the years ahead, leading to a peak in overall road fuel demand in 2027.

Demand in the US and Europe has already peaked, while demand in China is set to peak in 2024. Global oil demand from two-wheelers, three-wheelers and buses has also already peaked and demand from passenger cars is set to peak in 2025. By contrast, the commercial fleet will take longer to decarbonise as heavy-duty vehicles, such as trucks, continue to rely on diesel to move booming freight demand.

Decarbonisation

Latest news from the European Commission reported that the power sector has been the number one driver of carbon dioxide emissions reduction under the EU Emission Trading System (ETS).

With emissions from power production having decreased by an impressive 24% compared to 2022, the sector is well on its way to achieve carbon neutrality by 2040. As mentioned in the Commission’s article, such unprecedented decrease was mainly due to rapidly increasing wind and solar generation at the expense of both coal and gas.

The recovery of hydro and nuclear power due to more favourable climate conditions also contributed to the emissions decrease, but to a lesser extent.

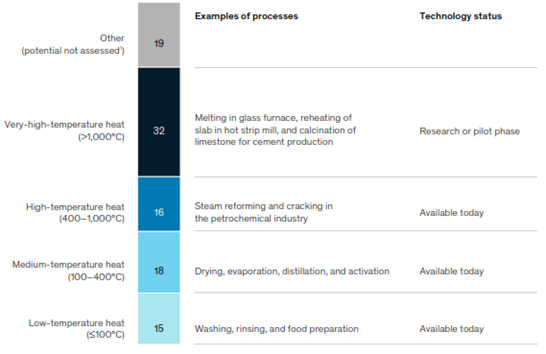

The potential of direct electrification remains largely untapped when it comes to industry. As shown by the study undertaken by McKinsey, of all the fuel that industrial companies use for energy, the estimation is that at least 50 percent could be replaced with electricity, using technologies available today. This includes all energy required to generate heat for industrial processes up to approximately 1,000 degrees Celsius.

Electrification of industrial processes that require heat up to approximately 1,000 degrees Celsius does not require a fundamental change in the industrial process setup, but rather a replacement of a piece of equipment, such as a boiler or furnace, running on conventional fuel with a piece of electric equipment.

Up to a heat demand of approximately 400 degrees Celsius, electric alternatives to conventional equipment are commercially available. Electric heat pumps for low- and medium-temperature heat demand and electric-powered mechanical vapor recompression (MVR) equipment for evaporation are already used on some industrial sites. Electric boilers that can generate industrial heat up to approximately 350 degrees Celsius are widely available.

The maturity of electrical equipment determines what processes can be electrified. The pace at which electric technologies for very-high temperature industrial processes such as steel and cement production are developed and proven at scale will dictate when they can be applied widely on industrial sites.

What is hampering electrification in Europe today?

Even if successful cases of electrification are numerous, so are the barriers that are preventing electrification from playing its role in the energy transition. Such barriers act at both transversal and sector specific level, and often prevent citizens and businesses from switching to cleaner solutions.

Let’s analyse these barriers one by one.

Technology

General barriers related to the technology for electrification solutions imply more aspects than just the actual performance of the technology itself. In some cases, users may not fully perceive the benefits from electrifying their energy needs, while outdated assets such as aged buildings with insufficient cable capacity and obsolete transport systems with outdated infrastructure may pose challenges in terms of integration and interoperability of new technologies.

Energy efficiency is often still perceived as strictly related to insulation and operational efficiency rather than to fuel switch savings.

Aversion to change is another relevant issue, where installers and businesses may perceive electrification as a commercial risk instead of an opportunity for increased shared value. Finally, some solutions struggle to appeal to consumers, as they may not look as attractive and accessible as other mass market products, even if their economic and lifestyle returns may be larger.

To recap, the main technology barriers for electrification are:

- Untapped potential of electrification benefits to consumers and lack of users’ expertise and habits, paired with a lack of public support and perception of low investability and profitability

- Challenges related to energy system integration, complexity and interoperability

- Skills gap, supply chain tightness in some instances often paired with a negative perception and lack of information from sectors

- Ongoing implementation and R&D support of short- and medium-term innovations in market products

- Lack of fully operational large-scale demonstration and reference projects directly applicable in households, services, public buildings and industry

Infrastructure

The lack of adequate infrastructure poses a key barrier for electrification. The state of European grids risks becoming the number one bottleneck for electrification in the future, particularly when taking into account new technologies and the changes in prosumers behavior.

Grid congestions are increasingly jeopardising the capacity to manage new connection requests, and the infrastructure is often not smart enough to deal with the challenges placed by the digitalisation of energy consumption and self-production.

Moreover, despite the capacity of electrical solutions to be controlled, demand-side flexibility and equipment control are still poorly developed.

The main infrastructure barriers for electrification thus are:

- Capacity issues with the grid including long lead times for grid connection

- Lack of large-scale rollout of digitalised infrastructure solutions and system integration

- Lack of focus on power grid investments as gas – and now also carbon capture and storage (CCS) – infrastructure are competing for available EU infrastructure funding, see e.g. TEN-E program.

Funding

EU citizens and businesses are already under economic pressure due to the increase of their energy bills. Even though emergency measures were adopted, energy prices soared as consequence of geopolitical and socio-economic contexts. Energy prices in European markets have not yet gone below pre-pandemic levels and global projections foresee that they will not recover such levels in the near future. The result is that citizens and businesses often lack the financial resources to face energy-related investments and continue to struggle with insufficient energy savings and steep bills.

Uneven taxation and continued subsidies to fossil fuels continue to be part of the problem. According to the European Environment Agency, EU fossil fuel subsidies remained at considerable levels of about €56 billion (2022 prices) over the period 2015-2021, constituting a main barrier for the transition as well as providing misleading incentives to the public. Furthermore, renewable energy source (RES) surcharges are often levied only on electricity and not on other energy carriers.

Main funding barriers for electrification are:

- Poor economic indicators paired with continuous subsidies and support schemes for fossil fuels

- Lack of access to finance including lack of information on available financing options

- Split incentives dilemma for both energy efficiency and electrification investments, implying that the subject ultimately responsible for carrying out investments on electrification is often not the main beneficiary of the energy and monetary savings to be made from that intervention

- Inadequate tariff structure and energy taxation frameworks which still favour fossil fuel over electricity use

- Insufficient implementation of the energy and climate efficiency first principle in policy frameworks

What is hampering transport?

The electrification of EU transport faces several barriers that range from the current level of EV market maturity to the insufficient deployment of e-mobility infrastructure up to perception issues. The number of EV models available in the market is still way below other options, and often does not cover all segments and consumers appeals affordably.

Moreover, as the introduction of EVs in European markets is recent, the availability of used vehicles - something of uttermost relevance for consumers with low purchase capacity - is still very limited. EV ranges and charging times are still not comparable to traditional vehicles, and the upfront cost of an EV is higher than of an internal combustion engine (ICE) vehicle, as manufacturers have to still cash in the large investments in the manufacturing value chain in recent years.

Main barriers to electrified transport are:

- Vehicle battery capacities and charging speeds still improvable across the available EV portfolio.

- Charging infrastructure rollout, especially in Eastern Europe, as well as grid capacity issues, particularly for HDV charging

- Lack of rollout of digitalised infrastructure solutions including data interoperability, as well as increased integration with smart technologies and vehicle-to-X (V2X) to better manage energy demand.

- Higher purchasing price for EVs compared to ICE vehicles as well as insufficient number of second-hand vehicles on the market which can drive prices down

- Lack of a truly European value chain and high dependency from imports from outside the EU, such as on batteries and other components

What is hampering building?

The buildings sector is characterised by considerable inertia and lengthy lifetime of its assets. Changes often occur slowly, and once installed, technologies often stay in use for decades due to design issues and challenges that adopting deep energy renovations pose.

Barriers include elements related to the lack of users’ expertise, their attitudes and habits, restrictions in installers’ skills and delivery portfolio, challenges in integration and complexity, and lastly, high upfront costs of renovations as well as insufficient and ever unstable incentive frameworks.

Main barriers to electrified buildings are:

- General lack of an EU-wide policy framework for a transition to decarbonised and electrified heating and cooling. The Energy Performance of Buildings Directive (EPBD0 is, despite its recent revision, a Directive requiring adequate implementation at Member State level which is often not the case. Moreover, there are inadequate criteria to evaluate buildings’ performance, e.g. the focus of the EPBD is on reducing the primary energy consumption rather than on emissions reduction

- Insufficient offer of adapted solutions for certain sub-sectors, especially in multi-family buildings including architectural and technical constraints as well as a lack of related demonstration projects

- A large range and variety of available technologies leading to complex information and lack of awareness for consumers. Generally, there seems to be a lack of information and promotion of available and efficient electric solutions for heating and cooling

- Limited installation capacity combined with current supply chain and manufacturing limitations. Long waiting times and lack of trained personnel to execute the installations

- Slow pace of renovations across Europe and very high number of old and inadequately insulated buildings – especially in Southern and Eastern Europe

- Lack of digitalised grid solutions rolled out to alleviate congestions and accelerate electrification of buildings paired with insufficient development and promotion of energy management equipment to facilitate demand side flexibility

- High upfront costs for electrified solutions such as heat pumps. This is combined with persisting subsidies for standalone fossil fuelled boilers across the EU as well as for other technologies using fossil energy and lack of sufficient financing incentives for heat pumps, paired with a lack of stability and consistency of incentive mechanisms for decarbonised heating solutions

- A delayed EU Heat Pump Action Plan by the European Commission that would boost the rollout of heat pumps and remind Member States about the importance of higher ambition is creating further insecurity for the sector.

- Economic challenges with decarbonisation of large-scale district heating systems, as available options are either not economically viable yet or might suffer from feedstock shortages, such as in the case of biogas

- Organisational and cultural barriers which imply complex and long decision-making processes (in co-owned buildings for example) when investing in sustainable solutions. Habits, low acceptance levels and lack of knowledge of possible cost-savings are further obstacles

- High electricity primary energy factors (PEF) which are often two to three times higher compared with fossil fuels putting power solutions at a disadvantage. Lower PEF values for renewables and a specific PEF for electricity would in turn incentivise cleaner energy use, ideally paired with periodic adjustments reflecting technology advances and considering energy storage impact

What is hampering industry?

European industries face substantial barriers to electrify their operations. Cost-competitive electric technology applications are needed to enable further electrification of industry. There are different mature technologies to electrify industrial processes and industrial heat.

Industrial heat pumps can be a viable option for low and medium temperature heat needed in many industries, including pre-heating for high temperature applications, if the right regulatory frameworks are in place. Electric boiler, electric furnace, mechanical vapour compression also exists and are mature technologies that could develop within an appropriate regulatory and incentive framework.

Main barriers for an electrified industry are:

- Lack of advanced and commercially viable technological solutions for the electrification of heavy-duty industry with high-grade heat requirements,

- Limited number of manufacturers for electrified solutions combined with a long lifespan of existing equipment, as well as a limited number of existing examples

- Higher upfront costs for electrified solutions such as electric arc furnaces, as well as induction and resistance furnaces that apply generally in the metallurgical sector, both on the captical expenditure (CapEx) and operating expenditure (OpEx) side. Need of bespoke designs instead of standardised and replicable solutions

- Carbon pricing and related EU policies do not seem to incentivise a faster pace of decarbonisation for heavy industry as seen in the stagnant electrification rates overview

- Lack of awareness of heat consumption in companies as well as more systemic solutions such as the consideration of large-scale use of excess heat from industrial processes for residential heating

- General lack and incoherence of incentive mechanisms for investment and exploitation of electric solutions in industry – industrial policy remains largely a national competence with little room for EU-wide frameworks. Existing EU-wide tools such as State Aid legislation with its General Block Exemption Regulation often lack focus on specific electrification solutions

- Insufficient knowledge and awareness regarding available technologies and their capabilities. Need for combined knowledge of both process and electrical technology.

How to overcome barriers to electrification in Europe?

Eurelectric has identified and reviewed policy measures to accelerate the uptake of electrification in final energy consumption. The measures were carefully assessed in terms of their feasibility and ability to rapidly deliver emission reductions in final energy uses.

Governance

EU policymakers should set visible electrification targets and monitor the progress achieved across EU countries. This means introducing an indicative electrification target of 35% of final energy use across the EU by 2030. The target should be accompanied by an electrification indicator in the national energy and climate plans (NECPs) to monitor and deliver progress. This will send clear investment signals across the energy supply chain, enable anticipatory investments in grids and provide predictability in terms of the workforce needed.

Security of supply

The supply disruption at the scale experienced in 2022 has made our energy supply vulnerability to fossil fuel imports painfully clear. In setting electrification targets, policy makers at both the EU and national level should therefore duly reflect on this exposure to volatile imports, not least with regards to potential cost savings in the future: the positive impact of large-scale electrification with clean domestic power generation on security of supply is immense and should be duly acknowledged in energy policy and related investment decisions.

Market signals

Letting the electrification business case emerge by reflecting all costs and benefits is now more needed than ever. For this to happen, we must remove any non-electricity related taxes and levies from electricity bills. This will provide for transparency when comparing costs and create favourable economic conditions for consumers to switch from more carbon-intensive energy carriers.

Generic policies supporting vulnerable consumers or urban waste management should not be paid through electricity bills, but through general taxation. By the same token, incentives for fossil fuel-based residential heating must be phased out as soon as possible and visible incentives for decarbonised and electrified heating solutions must be upgraded. Especially in building and transport support mechanisms aimed at reducing upfront costs of heat pumps and EVs should be complemented by a clear and reliable carbon price emerging from the ETS2.

Competitiveness

The power sector must play a bigger role in decarbonising industry and contribute to its competitiveness by providing clean, affordable energy. Specific economic barriers need to be addressed when it comes to increased electrification of industrial processes as well as buildings. We need adequate incentives for pilot projects to further reduce high upfront costs for some processes and tackle the general lack and incoherence of incentive mechanisms for investment and exploitation of electric solutions in industry, in particular.

Existing EU-wide tools such as State Aid legislation with its General Block Exemption Regulation should take into account decarbonisation and electrification solutions for industry. Network codes on demand response should support DSOs in selecting the most economically efficient solutions for flexibility services through appropriate long term remuneration schemes.

Infrastructure fit for net-zero

Bringing our infrastructure up to speed with the energy transition through grid modernisation is a key precondition. This is especially true at distribution grid level and in many constituencies grid’s expansion and digitalisation are long overdue.

One-third of the EU’s distribution grids are already over 40 years old as proven by the Eurelectric Connecting the Dots study. We need to urgently invest in grids to be fit-for-purpose in an increasingly decarbonised, decentralised and digitalised power system. In light of a rapidly evolving context, specific policy measures should promote an anticipatory grid build-out and an immediate reform of the TEN-E legislation to adequately include distribution grids.

Implementation

We must ensure that planned legislation hits the ground. A lot of EU legislation has been agreed but often not implemented adequately at Member State level, such as the Clean Energy Package (CEP) and the newly adopted Fit for 55 (FF55) package which would be essential to accelerate electrification.

Before adding on new legislative layers, proper delivery of existing ones should be assessed and prioritised. To stay with the example of the CEP, its implementation would allow consumers to sign up for dynamic price offers or be rewarded for flexibility that they provide to grid operators which would ultimately untap the flexibility opportunities and further incentivise the use of electric heating solutions such as heat pumps. FF55 provisions should promptly be integrated into NECPs and national legislation, particularly with regards to permitting provisions.

Awareness

Adequate levels of information and transparent comparison are key but often missing for consumers. In many communities, consumers are simply not aware or even misinformed about true cost implications and available incentives when choosing between fossil fuel and clean electric heating or transport solutions. This needs to be alleviated.

Communities should be informed about existing incentives for decarbonised and electric solutions. Access to these incentivises should also be made as simple as possible, such as by reducing paperwork in the application procedure or by providing of accessible and reliable comparison tools.

Measures that can help raise awareness are communication campaigns, training programs, the creation of electrification observatories to ensure credible and unbiased information as well as promoting the necessary upskilling and reskilling programs.

At almost five years left until 2030, it’s time for a European Electrification Action Plan to supercharge Europe's energy transition.